Blog

March 26, 2019 | Authored by: Vindicia Team

Tackling passive churn for subscription growth

A positive user experience is essential to growth and success for any subscription-based company. Consumers have many options at their fingertips, and they aren't going to look solely at the quality of the product or service — they'll also look closely at the customer experience. One bad experience, in turn, could prove to be the catalyst that sours an otherwise satisfied, paying customer and takes revenue off the table.

Of course, subscription-based companies do all they can to avoid such missteps by designing highly intuitive interfaces for streaming platforms, offering expedited shipping, saving purchase history for easy reorder or personalized recommendations. All of these steps are taken to prevent churn.

There are two types of churn, active and passive. The former is when a customer decides to leave on their own, while the latter is when an account is terminated unwillingly. Despite all the effort businesses devote toward experience enhancements that address active churn, many are less equipped to deal with passive churn. This occurs either because the risk isn't known, or the capacity just isn't there to tackle it.

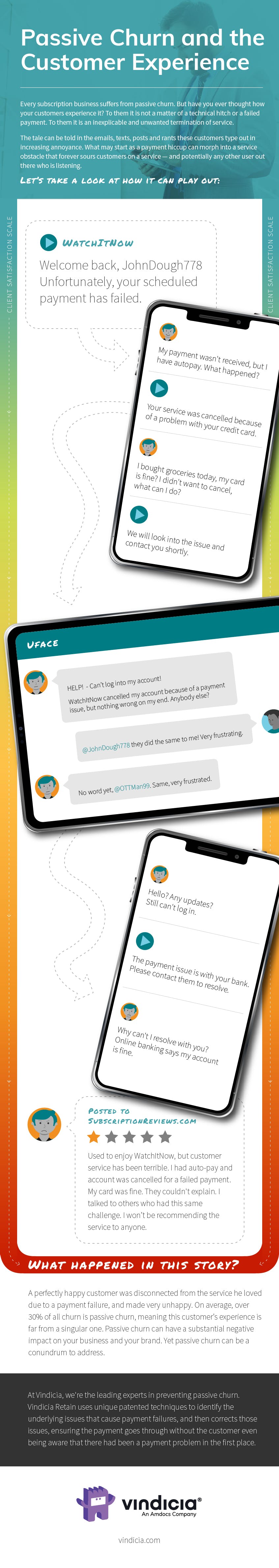

However, the story of passive churn from the customer's side tells a cautionary tale that businesses ought to take a lesson from — bad experiences multiplied across the customer base can be seriously damaging.

Payment failures, the root of much passive churn, are difficult to detect and laborious to resolve. Yet their impact is undeniably negative.

Consider the experience of our John Dough, one that is fictional in nature, but wholly representative of the real risk of passive churn and a displeasing customer experience: Upon getting an email notifying him that a payment was not processed, John is confused because he had opted into AutoPay. When the subscription company doesn't have an immediate resolution, John goes digging and finds that he's not the only one to experience such payment pains.

After not getting another response from the company, John asks what the deal is. The real frustration sets in after he is redirected to his bank by customer service because of an apparent account issue, but discovers no problem on his online banking app. The result is a customer who was once thrilled with the subscription leaving the service and writing a bad review that warns off family, friends, and whoever finds the review online.

Countless experiences such as this one occur across the subscription business landscape, but many services lack the tools or the talent to successfully rein in passive churn and guard against losses. The customer experience plays a pivotal role at each stage of subscription customer lifecycle management. And while businesses may be successful in minimizing active churn, passive churn can prove to be a consistent risk. With an affordable investment in Vindicia Select technology, brands can gain the capability to monitor and control passive churn. Contact us today for more information about our solutions, service, and industry expertise. And for additional insight into how Select can cut passive churn at your subscription business, check out the Forrester study "The Total Economic Impact of Vindicia Select."

About Author

Vindicia Team

We value our subject matter experts and the insights each of them brings to the table. We want to encourage more thought leaders to come together and share their industry knowledge through our blog. Think you have something interesting to contribute as a guest blogger? Contact us at info@vindicia.com